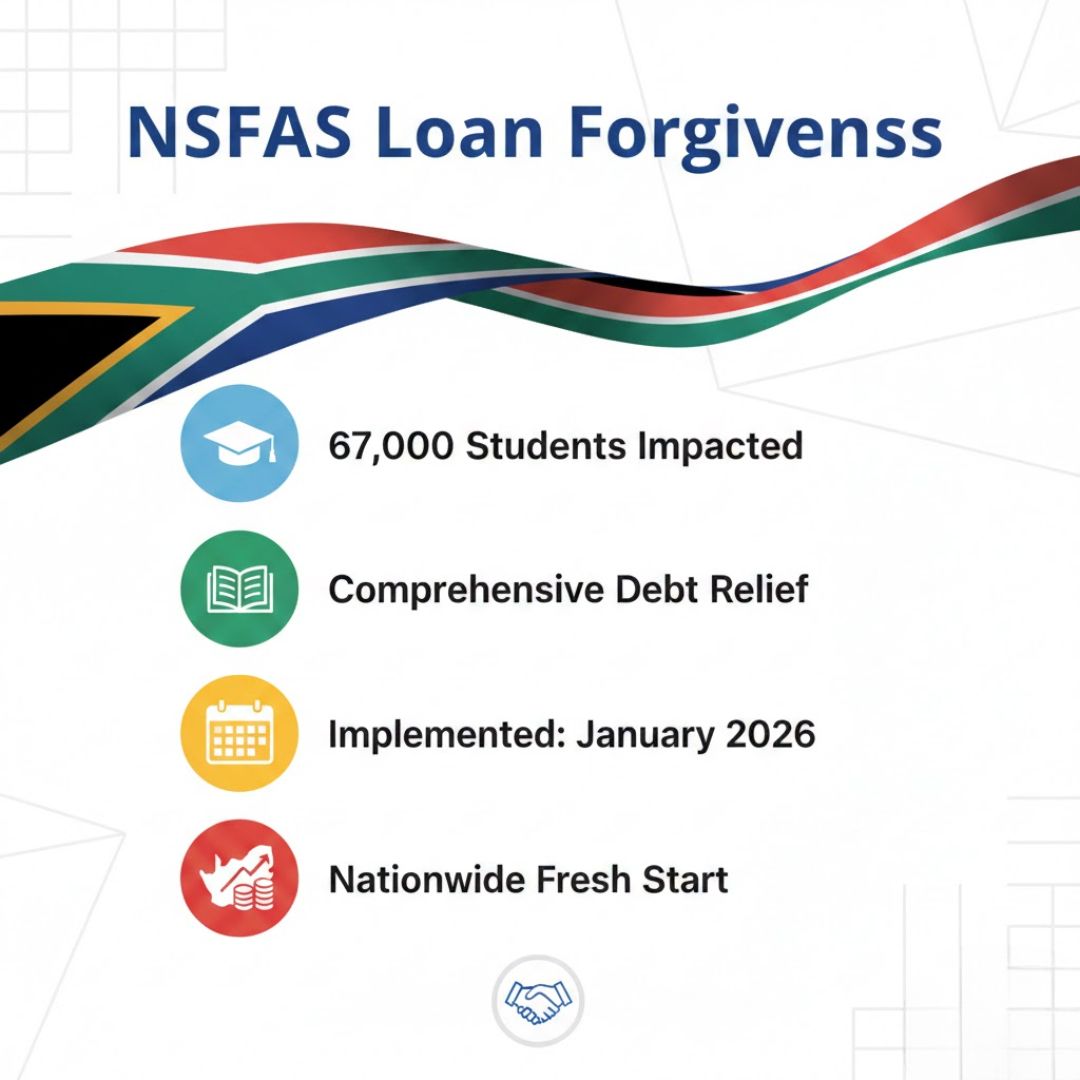

South African students are receiving a major financial relief this month as NSFAS rolls out its comprehensive loan cancellation programme. An estimated 67,000 students stand to benefit from this initiative, which aims to ease the burden of educational debt and improve access to higher education. The programme is part of the government’s broader strategy to support tertiary education funding and ensure students can complete their studies without the stress of overwhelming student loans. Universities and colleges across South Africa are preparing to implement these changes immediately, offering a lifeline to thousands of learners.

NSFAS Loan Cancellation Programme Details

The NSFAS loan cancellation programme in South Africa is designed to target students who have met academic requirements and maintained good repayment records. The initiative covers both partial and full loan forgiveness, depending on individual circumstances and the type of study. Eligible students will see their debts cleared in phases, with automatic processing to reduce administrative delays. This move is expected to increase graduation rates and provide immediate financial relief for those struggling with loan repayments, giving them the freedom to focus on their academic goals.

Who Qualifies for the Loan Cancellation

Eligibility for the NSFAS loan cancellation programme is based on several criteria, including completion of studies, income thresholds, and a clean loan history. Students who have previously defaulted may qualify for partial forgiveness after meeting repayment arrangements. Priority is given to learners from disadvantaged backgrounds, ensuring that financial barriers do not prevent access to tertiary education. The programme also considers study level, with both undergraduate and postgraduate students included. The goal is to make higher education more equitable and provide tangible economic relief to struggling graduates.

Impact of Loan Cancellation on Students

The cancellation of NSFAS loans is expected to have a transformative effect on South African students. By eliminating debt, graduates can pursue career opportunities without financial stress, increasing employment prospects and boosting economic participation. The programme also fosters mental well-being by reducing anxiety linked to long-term debt. Universities anticipate higher student retention rates and improved academic performance as learners are freed from financial pressures. Overall, the initiative strengthens the education system while promoting social mobility and long-term financial stability for thousands of South African students.

Summary and Analysis

NSFAS’s comprehensive loan cancellation programme represents a significant step towards alleviating student debt in South Africa. By focusing on eligible students and ensuring automatic processing, the initiative removes barriers to higher education completion and provides immediate financial relief. This programme not only benefits individual learners but also supports the national economy by enabling graduates to enter the workforce debt-free. With careful implementation and ongoing monitoring, NSFAS can ensure that the loan forgiveness programme achieves its goals of equitable access and sustainable educational outcomes.

| Criteria | Details |

|---|---|

| Number of Students Benefiting | 67,000 |

| Loan Types Covered | Undergraduate & Postgraduate |

| Eligibility | Completed studies, income thresholds, clean loan history |

| Processing | Automatic phased cancellation |

| Priority Group | Disadvantaged backgrounds, high academic performance |

Frequently Asked Questions (FAQs)

1. What is the eligibility?

Students must have completed studies and meet income and loan history requirements.

SASSA R1,500 Grocery Support Alert: Application Deadline Set for 2 February With Miss-Out Warning

SASSA R1,500 Grocery Support Alert: Application Deadline Set for 2 February With Miss-Out Warning

2. How many students benefit?

Approximately 67,000 students are expected to receive loan cancellations this month.

3. Are postgraduate students included?

Yes, both undergraduate and postgraduate students qualify for loan forgiveness.

4. How is the cancellation processed?

NSFAS implements automatic, phased loan cancellation to streamline the process.