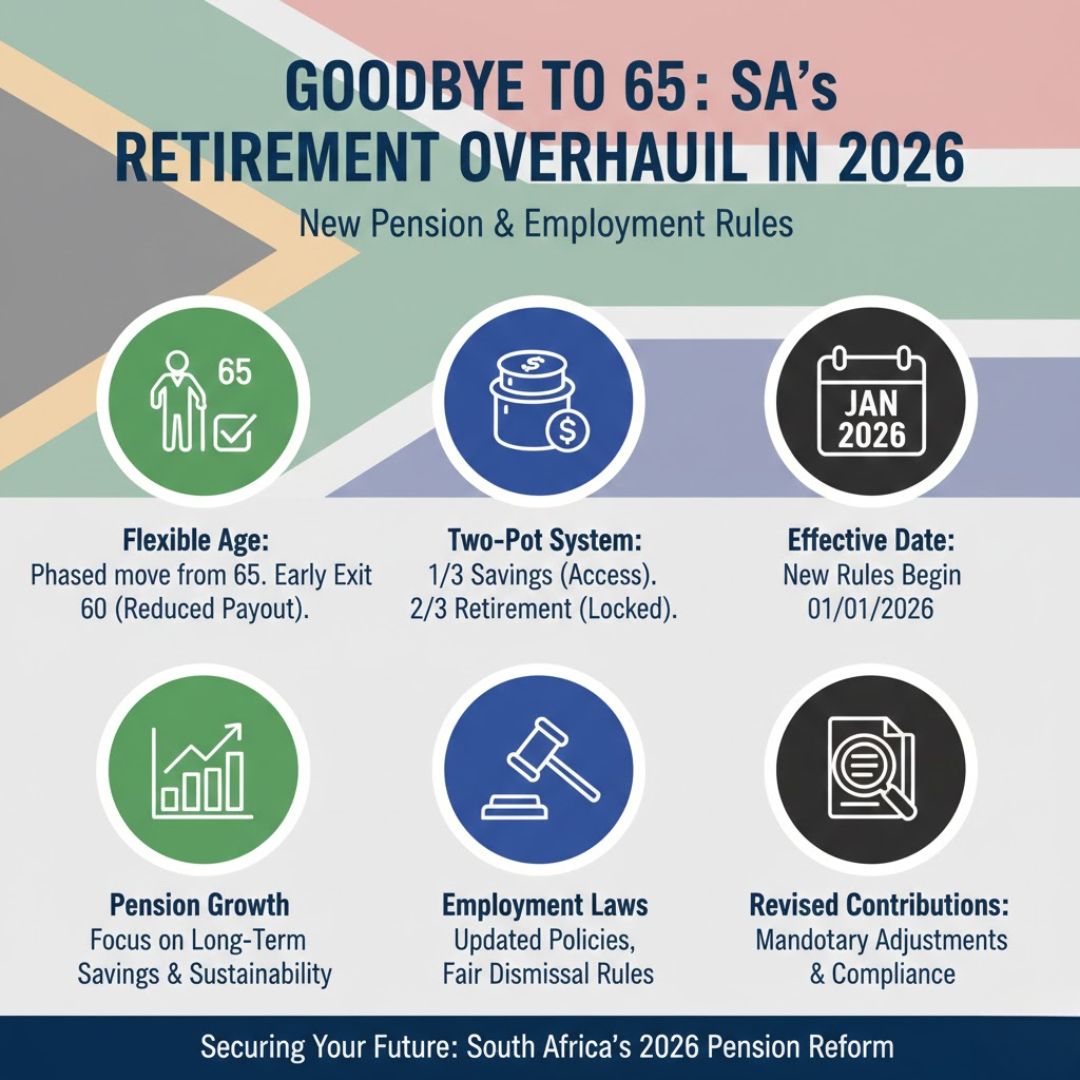

South Africa is set to undergo a significant transformation in retirement and pension policies in 2026. The traditional retirement age of 65 years is being reevaluated as part of a broader government reform aimed at aligning employment rules with modern workforce trends. This overhaul affects both public and private sector workers, introducing flexible pension options and revised eligibility criteria. South Africans nearing retirement will need to adapt to these changes to secure their financial future and ensure continued compliance with the new retirement framework.

New Retirement Age Regulations

The government has announced updated retirement age rules that gradually increase the minimum retirement age for most workers. This policy shift is designed to support longer workforce participation and reduce pension system strain. Employees now have options to continue working beyond traditional retirement thresholds while still contributing to their pension funds. Employers are also expected to provide guidance on phased retirement plans, ensuring that workers can transition smoothly without losing critical benefits or financial security.

Impact on Pension Benefits

With the retirement age changes, pension benefit calculations are also being revised. Early retirees may see adjustments in their monthly payouts while those who delay retirement could enjoy enhanced contributions and larger overall benefits. The reforms emphasize financial sustainability of public pension schemes and encourage individuals to plan for a longer post-employment phase. Additionally, new eligibility thresholds have been introduced, requiring South Africans to confirm service years and contribution history to secure optimal benefits.

School Calendar Shift Confirmed as January Holidays Begin Earlier Across South Africa in 2026

School Calendar Shift Confirmed as January Holidays Begin Earlier Across South Africa in 2026

Employment and Workforce Implications

Extending the retirement age has a direct effect on the labor market dynamics in South Africa. Employers must adapt to a more experienced workforce while creating opportunities for younger employees. Flexible work arrangements and part-time options are encouraged to balance productivity and workforce retention. This shift also highlights the importance of skills upgrading and continuous professional development, ensuring that older employees remain competitive and valuable contributors to their organizations.

Summary and Analysis

South Africa’s retirement age overhaul marks a significant policy evolution with far-reaching effects on pension security, employment practices, and financial planning. Citizens must familiarize themselves with new eligibility rules and adjust their retirement timelines accordingly. The changes aim to foster a more resilient pension system, encourage long-term workforce participation, and provide individuals with greater flexibility in managing their post-retirement lives. Careful planning will be essential to maximize benefits and ensure a smooth transition under this new framework.

| Aspect | Details |

|---|---|

| New Minimum Retirement Age | 67 years for most workers |

| Early Retirement Option | Possible with reduced benefits |

| Delayed Retirement Benefits | Increased pension contributions |

| Employer Obligations | Provide phased retirement guidance |

| Eligibility Requirements | Minimum service years confirmed |

| Workforce Adaptation | Flexible hours and skills upgrading |

Frequently Asked Questions (FAQs)

1. What is the new retirement age?

The new minimum retirement age is 67 years for most workers.

2. Can I retire earlier than the new age?

Yes, but early retirement comes with reduced benefits.

3. How does this affect pension benefits?

Delaying retirement increases monthly payouts and overall contributions.

4. Are employers required to adjust policies?

Yes, employers must offer phased retirement options and guidance.