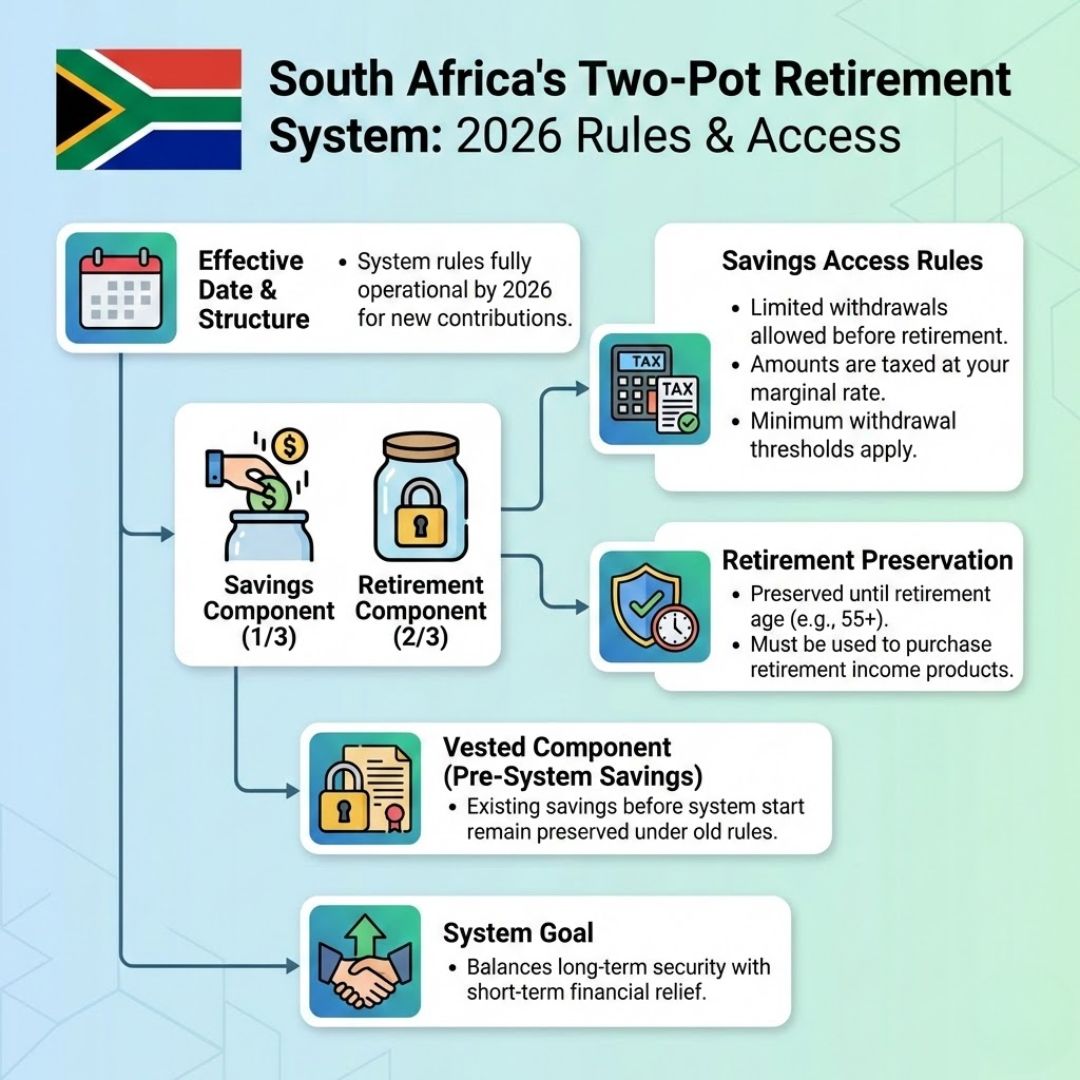

South Africa is preparing for a major shift in how retirement savings work, as the new two-pot retirement system comes into effect in 2026. This reform is designed to give workers earlier access to a portion of their savings while still protecting money meant for retirement. For many employees, the change answers a long-standing problem: what to do when financial pressure hits before retirement age. By restructuring how contributions are divided, the system aims to balance short-term needs with long-term security for South African workers.

How South Africa’s two-pot retirement system works

The new framework restructures retirement funds into what is commonly called a two-pot system, marking a significant retirement reform for the country. Under this approach, contributions are split so that part of the money remains locked in until retirement, while another portion becomes accessible savings during a worker’s career. The idea is to reduce the temptation to fully cash out when changing jobs, while still offering relief when life throws unexpected expenses your way. By protecting long-term preservation, policymakers hope workers will retire with stronger financial stability than in the past.

What changes for workers’ access to savings

From 2026, contributions will be divided between a savings component and a retirement component, each with different rules. The savings portion can be tapped under specific conditions, allowing partial withdrawals without ending employment. This is a major shift from the old system, where accessing funds often meant resigning. However, withdrawals won’t be completely free of consequences, as tax considerations will still apply. Understanding when and how to access this portion will be crucial for workers hoping to avoid unnecessary penalties.

School Calendar Shift Confirmed as January Holidays Begin Earlier Across South Africa in 2026

School Calendar Shift Confirmed as January Holidays Begin Earlier Across South Africa in 2026

Why the two-pot retirement rules matter in 2026

The reform is expected to give employees more worker flexibility, especially during financial emergencies such as medical costs or temporary income loss. At the same time, it reinforces the importance of future security by keeping the majority of retirement funds untouched until the right time. Employers and fund administrators also face new responsibilities, including accurate reporting and employer compliance with updated regulations. Together, these changes aim to modernize South Africa’s retirement landscape without undermining its long-term goals.

Summary or Analysis

Overall, the two-pot model represents a balanced approach to retirement savings, addressing both present and future needs. As a major policy shift, it encourages workers to make more informed decisions about their money rather than relying on drastic measures. While the system won’t solve every financial challenge, it does promote healthier financial planning habits across the workforce. For South Africans who take the time to understand the new rules, 2026 could mark the beginning of a more flexible and secure retirement journey.

| Aspect | Old System | Two-Pot System (2026) |

|---|---|---|

| Access Before Retirement | Mostly restricted | Limited early access |

| Job Change Impact | Often full withdrawal | No forced cash-out |

| Retirement Protection | Weaker preservation | Stronger preservation |

| Tax Treatment | Once-off events | Applies per withdrawal |

Frequently Asked Questions (FAQs)

1. When do the two-pot retirement rules start?

The new two-pot retirement system is scheduled to begin in 2026.

2. Can workers withdraw money before retirement?

Yes, limited withdrawals are allowed from the savings portion under set rules.

3. Will early withdrawals be taxed?

Yes, any withdrawal from the savings pot will be subject to applicable tax.

4. Does this affect all retirement funds?

Most employer-linked retirement funds in South Africa will fall under the new system.